Tesla FinTech

Platform for business operations

Tesla FinTech platform is a solution encompassing billing, payments, settlements, and collections operations.

This platform unified multiple existing tools and added new capabilities for users.

About

My Role

Design Lead

Timeline

Released MVP in 6 months, continuously improved and supported the product

Team

Product Designer

Product Manager

Frontend Engineers

Backend Engineers

Context

11

Product Lines

40+

Countries

Internal Finance tools were developed prior to the company's rapid growth. However, as Tesla expanded, it became increasingly inefficient to handle the volume of millions of invoices, payments, and settlements in multiple separate tools.

User groups:

The Sales team, with the help of the Accounting team, uses tools to investigate problems with payments and process refunds

The Fin Ops team uses tools to research payments, open invoices, and the open credit lines

The Accounts Payable team processes incoming invoices and connects them with payments

Problems

Existing tools were disconnected; users had to jump from one tool to another to find all the needed information

The collections team had to use Excel to organize their workflow

Tools were not designed for scalability; it was impossible to use them for different product lines. As a result, teams tried to create separate tools for different product lines

Tools were not created for efficiency; information was hard to scan, and users had to spend a lot of time finding relevant details

Goals

Increase Efficiency:

Enhance operational efficiency by eliminating any unnecessary extra steps and manual processes

Consolidate Financial Tools:

Create a platform that connects finance tools into a single source of truth

Support Scalability and Growth:

Design the platform to be scalable and adaptable, to accommodate future business growth

Process

While I can't showcase extensive explorations and screens due to the sensitive nature of the finance platform, I'm excited to share insights into the process.

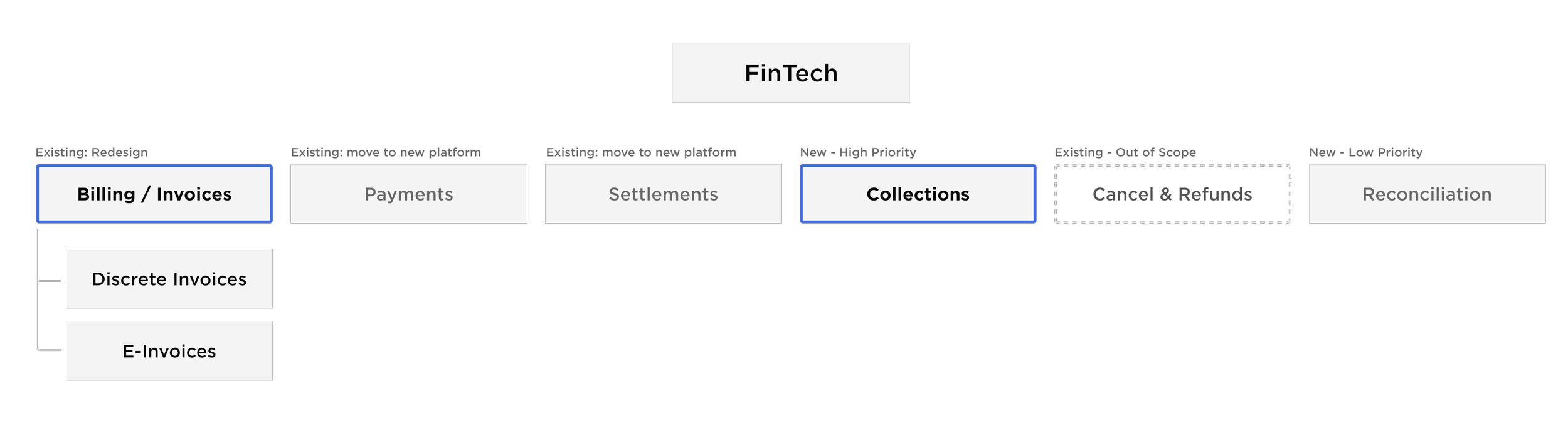

The first step was to understand all the finance systems we have, define what we want to include to FinTech and what is our priority #1.

Aligning around milestones and deliverables

After several alignment meetings with stakeholders, product managers and engineering partners, we defined the scope and next milestones. We analyzed business needs and identified Invoice Management - Billing and Collections as our top priority (#1).

Phase I - Collections

The collections team tracks payments and credit lines for both enterprise and non-enterprise customers, communicates with customers, and initiates collection or repossession processes as necessary

Research

Learn About Current Process:

We spoke with teams from US, UK and Netherlands:

The European team used SAP, but mentioned that it’s very complex and doesn’t cover a lot of use cases

North America used existing internal tools and collected all details in the form of cases using Excel and Jira

Competitive Audit

As part of the project, my designer conducted a thorough review of external fintech products and internal tools to identify relevant patterns that could inform our design approach. I worked closely with them to ensure the findings aligned with our project goals and user needs.

Reviewing Concepts with Users

It was important to review concepts weekly with the Collections team. As we moved fast, this process helped in catching missed use cases or mistaken assumptions before development.

Collections Users

Collections Specialist

Responsibilities:

Pursuing payment of overdue invoices and outstanding balances

Documenting all interactions and maintaining accurate records

Pain Points:

Process of consolidating, organizing data from various sources is time-consuming

Each specialist has offline notes for the accounts

Manual collections processes are prone to errors

Lack of visibility into accounts, needs to export reports to get a list of accounts

Customer Support Representative

Responsibilities:

Responsible for addressing customer inquiries and concerns related to unpaid invoices, providing assistance, clarification, and guidance as needed

Pain Points:

Lack of centralized platform for adding and viewing notes for collection specialists

Offline communication via MS Teams

User Flow

Designs

While working on these designs design team stayed in touch with collections team and reviewed designs on bi-weekly basis. User feedback helped validate design decisions and ensures that the final product meets user needs and expectations.

Iterations & Learnings

Iterating was essential to uncover hidden user needs and ensure the design addressed real-world workflows effectively.

During testing with users, we learned that the latest updates to notes were extremely important for them to act quickly, but these notes were hidden on the order page. We needed to make notes visible on homepage and account page.

Introduced a new section on the homepage - 'Notes.' Users can view the latest notes and quickly open orders to take action.

Added the ability to immediately see which orders have new notes at the order level as well, enabling users to quickly identify which orders they need to focus on.

Phase II - Billing and Global Search

From interviews, we learned that users typically begin an investigation by searching, whether for an invoice number, account ID, payment number, or transaction number. Similarly, the Payments team initiates many workflows with searches for payment numbers, invoice numbers, and the Accounts Payable department searches for invoice numbers too.

To streamline this process, we decided to implement a global search feature on the FinTech homepage instead of supporting multiple separate searches.

Global Search

From existing processes we identified main search criteria:

Invoice Number

Payment Number

Account Name and ERPid

Order Number

Transaction Number

Search designed in a such way that users can narrow their search with specific criteria, which allows for quicker, more accurate results.

Right from the homepage, users can start searching for invoices, and from the search suggestions, navigate quickly to the invoice page.

Results

Seamless experience, which saves hours to finance team and millions to Tesla

Challenges

Fast-Moving Project Timeline - Adjusting Processes

With the project progressing rapidly, we had to skip some formal design reviews, opting instead for frequent offline communication to make timely decisionsEmpowering the Team While Maintaining Oversight

I learned the importance of balancing trust and control during this project—giving designers the autonomy to simplify complex financial workflows while stepping in to guide decisions where strict regulations limited simplifications.Complexity of Financial Operations

Finance platforms manage different operations like accounting, budgeting, payroll, and financial reporting. To design interfaces for these functions, I needed to grasp their workflows and how information moves from one area to anotherScalability

Customers might not see how complex finance systems are, with different rules in different countries and multiple invoices and payments. Our designs need to handle all these varied situations effectively.Integration with Existing Systems

"Integrating with the existing CRM posed challenges, occasionally slowing our development efforts. We often had to make trade-offs to achieve integration and implement solutions